Income Smoothing for High Earners: Reducing Future RMDs and Lifetime Taxes

Posted on: December 12, 2025

Roger Chen, CFA - MYeCFO Fractional CFO Services Leader

The most common questions I hear from high earning professionals and executives are:

- "Am I doing all I can to reduce my income taxes?"

- "As high W‑2 earners, what should be my overall lifetime tax strategy to optimize my taxes?"

- "Will my future required minimum distributions (RMDs) push me into even higher taxes later?"

- "Is there anything I can do now, while I'm still working, to help my future self and my family?"

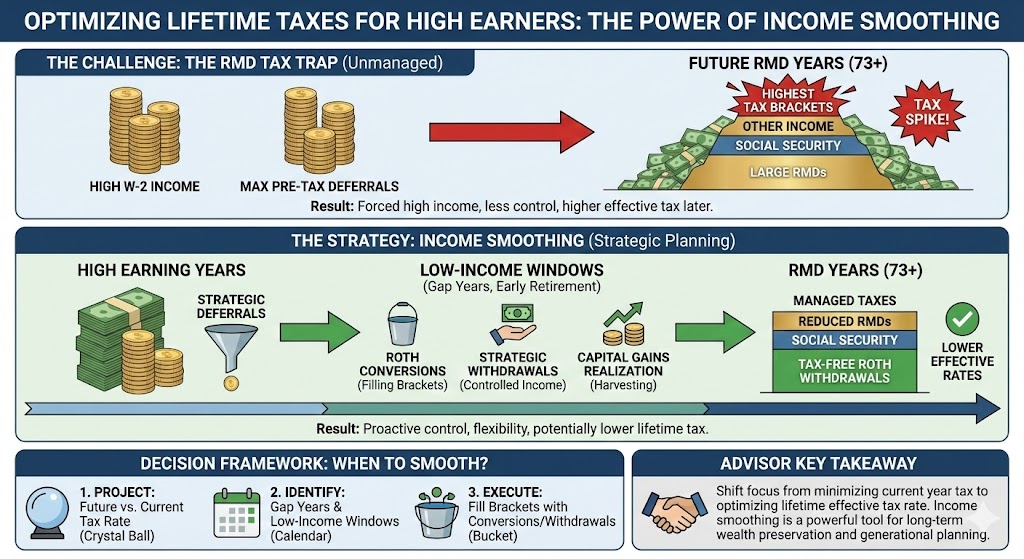

First of all, having steady high earnings and meaningful wealth accumulation is a good problem to have. The root challenge is that most households in this situation don't step back and look at the lifetime pattern of income and taxes. Understanding the concept of "even out the income," or income smoothing, is a key to turning high current income into a more tax‑efficient, durable lifetime plan.

What "income smoothing" really means

For high earners, income smoothing is about managing when and how income is recognized so that fewer dollars are exposed to the very highest effective tax rates over your lifetime. Instead of focusing on "How do I pay the least tax this year?", the goal shifts to "How do I minimize total taxes over my life, and potentially across generations?"

Because the tax system is progressive and layered with thresholds (brackets, surtaxes, IRMAA, phase‑outs), sharp spikes in income are usually punished more than a steady, moderate flow of income over time. Deliberately smoothing income can reduce RMDs later, lower exposure to future higher brackets, and create more flexibility for you and your heirs.

Why high RMDs are a problem

High‑earning households often do exactly what they've been told: maximize pre‑tax deferrals into 401(k)s, 403(b)s, and other plans for decades. The result is a very large pool of tax‑deferred assets. That is good news from a savings perspective, but there are side effects:

- RMDs at 73+ can become very large, especially if portfolios grow well.

- Those RMDs stack on top of Social Security, pensions, and other income, often pushing retirees into higher brackets than they expected.

- For married couples, when the first spouse dies, the survivor may face the same RMD level but now taxed at single brackets, often at a noticeably higher effective rate.

Put simply: if you never consciously manage the size and timing of future withdrawals, the IRS will do it for you through the RMD rules—and may do so at less favorable rates.

The planning opportunity: low‑income windows

Many high earners do have "valleys" in their lifetime income:

- Early retirement years before Social Security and RMDs start.

- A sabbatical, career transition, or year with much lower bonus/comp comp.

- A period when one spouse stops working and the other reduces hours.

These windows create a chance to intentionally recognize more income on your terms at more favorable tax rates, in exchange for smaller forced withdrawals later.

Core tools for income smoothing

Here are the main levers high‑earning households can use in lower earned‑income years to reduce future RMDs and lifetime tax:

Roth conversions

Move dollars from pre‑tax IRAs/401(k) rollovers into Roth IRAs in years when your taxable income is lower than it will likely be in RMD years. This shrinks the future RMD base and shifts growth into a tax‑free bucket.

Strategic early withdrawals

In some cases, taking controlled withdrawals from traditional accounts before RMD age (even if not converted) can make sense, especially if you are temporarily in a relatively low bracket and do not need all the cash immediately.

Capital gains realization and asset location

Use low‑income years to harvest long‑term capital gains at lower capital gains rates and to rebalance so that more of your future growth happens in Roth or taxable accounts with preferential rates, and less inside RMD‑heavy accounts.

Timing Social Security and pensions

Delaying Social Security can both increase benefit size and prolong your "gap years" of lower ordinary income, expanding the window for Roth conversions and controlled withdrawals.

A simple illustrative example

Assume a high‑earning couple, both age 60:

- They just retired from W‑2 roles, have saved $4,000,000 in combined pre‑tax retirement accounts and $1,000,000 in taxable/Roth.

- They plan to delay Social Security to age 70.

- From 60–70, they plan to live on a mix of taxable account withdrawals and some modest part‑time income.

If they do nothing beyond basic tax‑deferral:

- Ages 60–69: Their taxable income is quite moderate. They sit comfortably in middle brackets most years.

- At age 73: Their RMDs from $4M (assuming growth) may easily exceed six figures per year—on top of Social Security and any other income—pushing them into high brackets just as they have less flexibility.

- If one spouse dies first, the survivor faces the same RMDs plus their own Social Security, taxed at single rates.

If they use income smoothing from 60–69:

During each of the ten "gap" years before RMDs and Social Security, they intentionally "fill up" certain tax brackets with Roth conversions from their pre‑tax accounts.

Example structure (numbers simplified for illustration):

- Each year from 60–69, they convert $150,000 of traditional IRA/401(k) funds to Roth, on top of their base income.

- They design the conversion amount so that their taxable income each year reaches the top of a chosen bracket (e.g., they are willing to pay up to a certain marginal rate they expect to be lower than their future RMD‑year marginal rate).

- They pay the tax on conversions from their taxable savings, not from the IRA itself, preserving more of the IRA for conversion and future growth in Roth.

By age 70:

- They may have converted, say, $1.5M of their pre‑tax balance into Roth over 10 years.

- Their remaining pre‑tax balance is much smaller than it would have been otherwise, which substantially reduces RMDs starting at 73.

- The Roth balance now grows free of future RMDs for them and can be withdrawn tax‑free in retirement (subject to rules), or left as a more tax‑efficient inheritance for heirs.

Resulting effects:

| Benefit | Description |

|---|---|

| Smaller future RMDs | Less forced taxable income in the 70s, 80s, and for a surviving spouse. |

| More control over timing | They chose when to recognize income, rather than waiting for the IRS timetable. |

| Potentially lower lifetime tax | They voluntarily paid tax in their 60s at a rate they judged favorable, to avoid paying at a higher rate later when stacked with RMDs, Social Security, and single brackets for the survivor. |

The key point: they intentionally raised their income in relatively low‑income years to "smooth" their lifetime income curve, instead of letting it stay low in the 60s and spike sharply at RMD age.

A practical decision framework for you

For clients reading this, here is a simplified way to think about whether income smoothing actions (like Roth conversions) make sense in a given year:

1. Project future income and tax rate

- Estimate what your income and brackets might look like during RMD years and in a survivor scenario.

- If your future marginal rate on pre‑tax withdrawals looks as high or higher than today's marginal rate, that is a strong signal that smoothing may help.

2. Identify "low‑income windows"

- Early retirement years before Social Security and RMDs.

- Years with lower variable comp, a sabbatical, or one spouse taking time away from work.

3. Deliberately "fill up" target brackets

- Decide which tax bracket you're comfortable filling in that year.

- Use Roth conversions, controlled withdrawals, and capital gains realization to bring taxable income up to (but not far beyond) that target.

4. Coordinate with other thresholds

- Be mindful of Medicare IRMAA, ACA subsidies (if applicable), and major deductions/credits that can phase out.

- The real decision is about effective marginal rate, not just the nominal bracket.

5. Revisit annually

Tax law, markets, and personal circumstances evolve. Income smoothing is most effective as a series of smart annual decisions anchored to a long‑term plan, not a one‑time move.

Bringing it all together

For high‑earning households on track for large RMDs, the question is not just "How do I save tax this year?" It is "How do I shape my income pattern over decades so that fewer dollars are exposed to the very highest effective tax rates, and my family has more flexibility?"

Income smoothing, especially through thoughtful use of Roth conversions and controlled withdrawals in lower‑income years, is one of the most powerful tools to reduce future RMDs and potentially lower lifetime income taxes. The earlier you start viewing your finances through this lifetime lens, the more options you have to turn today's high earnings into a more tax‑efficient future for you and your heirs.

Disclosures: Non-deposit investment products are not FDIC insured, are not deposits or other obligations of MYeCFO, are not guaranteed by MYeCFO, and involve investment risks, including possible loss of principal. The information contained in this article is for informational purposes only and contains confidential and proprietary information that is subject to change without notice. Any opinions expressed are current only as of the time made and are subject to change without notice. This article may include estimates, projections, and other forward-looking statements; however, due to numerous factors, actual events may differ substantially from those presented. Any graphs and tables that make up this article have been based on unaudited, third party data and performance information provided to us by one or more commercial databases or publicly available websites and reports. While we believe this information to be reliable, MYeCFO bears no responsibility whatsoever for any errors or omissions. Additionally, please be aware that past performance is no guide to the future performance of any manager or strategy, and that the performance results displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, caution must be used inferring that these results are indicative of the future performance of any strategy. Index results assume re-investment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal, or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. Any investment advice provided by MYeCFO is client-specific based on each client's risk tolerance and investment objectives. Please consult your MYeCFO Advisor directly for investment advice related to your specific investment portfolio.